News

US AML Cases Hit Record Low in 2021, Sanctions Enforcement Remained Steady

Amid an overall decline in U.S. regulatory enforcement in every category, federal anti-money laundering actions rose in aggregate value last year but plumbed new depths in terms of volume as sanctions-related cases continued apace.

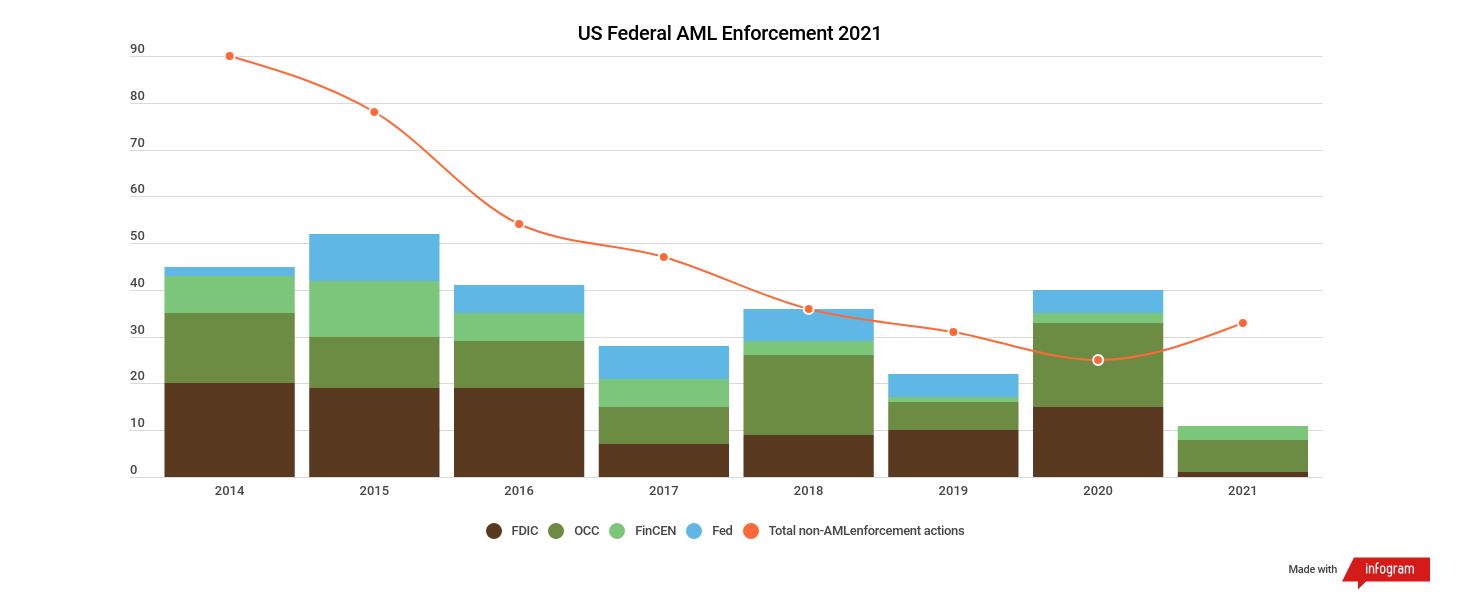

Data obtained and reviewed by ACAMS moneylaundering.com shows that AML-related actions disclosed by the Federal Reserve, Financial Crimes Enforcement Network, Federal Deposit Insurance Corp. and Office of the Comptroller of the Currency dropped from 40 in 2020 to 11 in 2021, which amounts to only half of their previous record low of 22 such actions in 2019.

All told, only 25 percent of the 44 total actions that the OCC, FDIC, Federal Reserve and FinCEN disclosed for a broad range of financial infractions last year tied back to AML, down from 62 percent of the 65 actions those agencies finalized in 2020 and 42 percent of the 53 they completed in 2019.

The FDIC and Fed did not disclose a single AML-related action in 2021.

But the downward trajectory does not reflect the full scope of U.S. AML enforcement last year nor predict future outcomes, said Daniel Stipano, former director of the OCC’s enforcement and compliance division, now partner at the Davis Polk & Wardwell law firm in Washington, D.C.

“I would not read a whole lot into that,” Stipano said, adding that the rapid pace of new AML-related regulatory investigations in 2021 has continued into 2022, setting the table for a bevy of cases going forward. “I think the Biden team, which is now fully in place, are going to be particularly aggressive regulators. I already see evidence of that in my practice.”

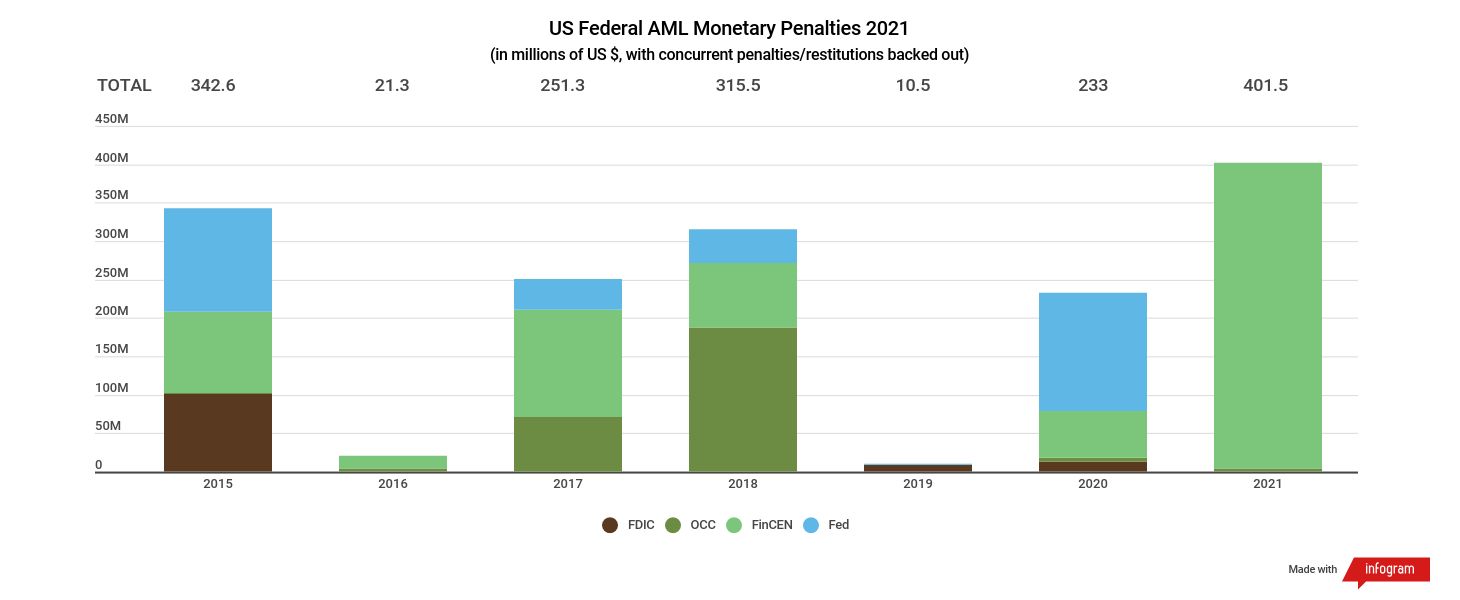

Six of the 11 AML-related actions brought by FinCEN or the OCC last year carried $402 million in combined penalties, led by the bureau’s initial extraction of $390 million from Capital One in January for violating the Bank Secrecy Act, or BSA.

Capital One “willfully” failed to file thousands of suspicious activity reports and “negligently” failed to file thousands of currency transaction reports on payments handled by its check-cashing unit from 2008 to 2014, allowing millions of potentially illicit dollars to enter the U.S. financial system, including funds linked to organized crime, tax evasion and fraud, FinCEN found.

In August, FinCEN joined the Commodity Futures Trading Commission, or CFTC, in fining BitMEX, a cryptocurrency derivatives exchange run from Seychelles, $100 million for providing unlicensed money transmission services to U.S. clients, concealing those services from federal officials and failing to report nearly 600 suspicious transactions from 2014 to 2020.

The penalty represents the bureau’s first against a futures trading platform.

FinCEN ended the year by ordering CommunityBank of Texas to hand over $8 million after the lender admitted to having knowingly ducked requirements to build an effective AML program.

CommunityBank also neglected to file SARs on hundreds of suspicious payments even after learning that some of the clients involved were under criminal investigation, the bureau found.

The OCC meanwhile assessed three AML-related penalties for a combined $3.5 million in 2021, down from $5.3 million in 2020 and far below the agency’s recent high of $238 million in 2018.

In March 2021, the regulator ordered Denton Douglas, former vice president of PNC Bank’s business banking unit in Delaware, to pay $35,000 for helping a previous client circumvent the lender’s know-your-customer controls by opening a new account through a “straw man.”

But the OCC’s assessment of a $2.5 million civil monetary penalty against Washington Federal Bank in October and $1 million penalty against CommunityBank of Texas in December of last year accounted for almost all of the agency’s total penalties.

The CFTC collected $50 million from BitMEX in August, up from the roughly $980,000 and $12.7 million in AML-related penalties that the regulator extracted in 2020 and 2019 respectively.

Five of the 13 monetary settlements, disgorgements, penalties and other punitive outlays secured by the Justice Department, Manhattan District Attorney’s Office or New York’s Department of Financial Services last year in response to financial crimes addressed AML violations or instances of money laundering specifically.

Together those five cases added up to $357 million in combined payments from the targeted institutions, topped by the $100 million that DFS assessed against Mashreqbank in October as part of a joint action with Treasury’s Office of Foreign Assets Control.

OFAC finalized 19 actions in 2021 and assessed $20.8 million in penalties, including $13.8 million against seven financial institutions. The agency’s finding of violation against Mashreqbank in November of last year in coordination with DFS did not include a penalty.

The chief compliance officer for a bank on the West Coast that regularly processes payments tied to international commerce said their institution delayed a larger share of transactions in 2021 to give staff time to gather and vet more details on the counterparties.

“We’ve been able to stop transactions until we get information, to find out if [the recipient] is a real company, not just some front,” said the compliance officer, who described the new strategy as a product of federal regulatory expectations.

Obtaining corporate registration records, ownership records and other datapoints from the counterparty’s bank usually requires holding up the payment in question, “because if the money’s already gone, of course they are not going to pay attention,” the compliance officer said. “Once in a while we get no response, because obviously their customer isn’t raising hell.”

Staying onside of U.S. sanctions also now requires deeper investigation at the onset of a transaction to determine whether any blacklisted individual or party owns 50 percent or more of the entity on the other end of the payment.

A designated individual may appear to control only 15 percent of a counterparty, for example, but their ownership history may suggest they still secretly hold a larger indirect stake.

“Russian oligarchs in particular, they divest,” the compliance officer said. “If he used to own 85 percent, don’t tell me he doesn’t still control it.”

The Securities and Exchange Commission’s enforcement division finalized 12 actions in response to AML, fraud, corruption and cybersecurity violations in 2021 for a combined $195 million in penalties, forfeitures and disgorgements, down from 14 actions for $1.8 billion in 2020 and 16 for $1.1 billion in 2019.

A year after finalizing 19 enforcement actions, all of them AML-related, for a combined $17.2 million in penalties in 2020, the SEC’s counterpart, the Financial Industry Regulatory Authority, completed 12 all AML-related actions in 2021 for $19.7 million in total value.

Priorities

FinCEN’s list of eight national anti-financial crime priorities, which the bureau published in June, had become as a key component of federal examinations by the end of last year, a compliance officer at a northeastern regional bank told moneylaundering.com.

“We’re doing a better job of cataloging those things so we can say that we have X number of cases that fit under” at least one of the priorities, including fraud, which has proven particularly difficult to detect and combat when conducted through peer-to-peer payment systems, the compliance officer said. “Within minutes that money is gone … and there’s no audit trail that’s going to get it back.”

Cryptocurrency companies, P2P platforms and other financial technology-centric firms, or fintechs, remained a top concern of federal regulators and investigators alike in 2021 amid indications that criminal abuse of decentralized, anonymous financial networks had risen dramatically.

“I think crypto is in the center of the radar screen for regulators these days,” said Stipano, the former OCC enforcement chief. “Right now, you’re seeing an effort by Congress and regulators to try to get their arms around it and ensure there is appropriate oversight.”

Cryptocurrency companies themselves face the unenviable task of having to build their AML policies and procedures from the ground up to comply with rules crafted with the mainstream financial services industry in mind, Stipano said. “That’s a huge challenge for those firms.”

The OCC also viewed risk-model validation, the process of testing quantitative tools designed to measure the risk associated with patterns of transaction activity, as a high priority for its team of examiners in 2021, a year that saw more banks bolster their transaction-monitoring systems with artificial intelligence and machine-learning software.

“From a supervisory perspective, we are monitoring those developments and implementing a review of new systems to ensure compliance and address issues that might arise,” an OCC compliance official told moneylaundering.com on condition of anonymity.

Banks separately began sketching out their plans for incorporating provisions of the AML Act of 2020 into their compliance programs, although the bulk of the regulations that will implement the legislation remain in development.

“A lot of banks are forward-looking, and we in turn are looking at their change management plans and trying to get in front of these issues, to the extent that there are any,” the OCC official said.

As for the perceived drop in enforcement in 2021, an official from the OCC’s enforcement division who also declined to be identified by name cautioned that publicly disclosed agreements and consent orders represent only a portion of the agency’s enforcement efforts, making them unreliable indicators at best.

Enforcement actions also often address flaws that came to light during previous years’ examinations, said the enforcement official, who separately noted that the OCC terminated several consent orders in 2021 after confirming that the banks targeted by them took solid and sustainable corrective measures to address their mistakes.

Fintrac

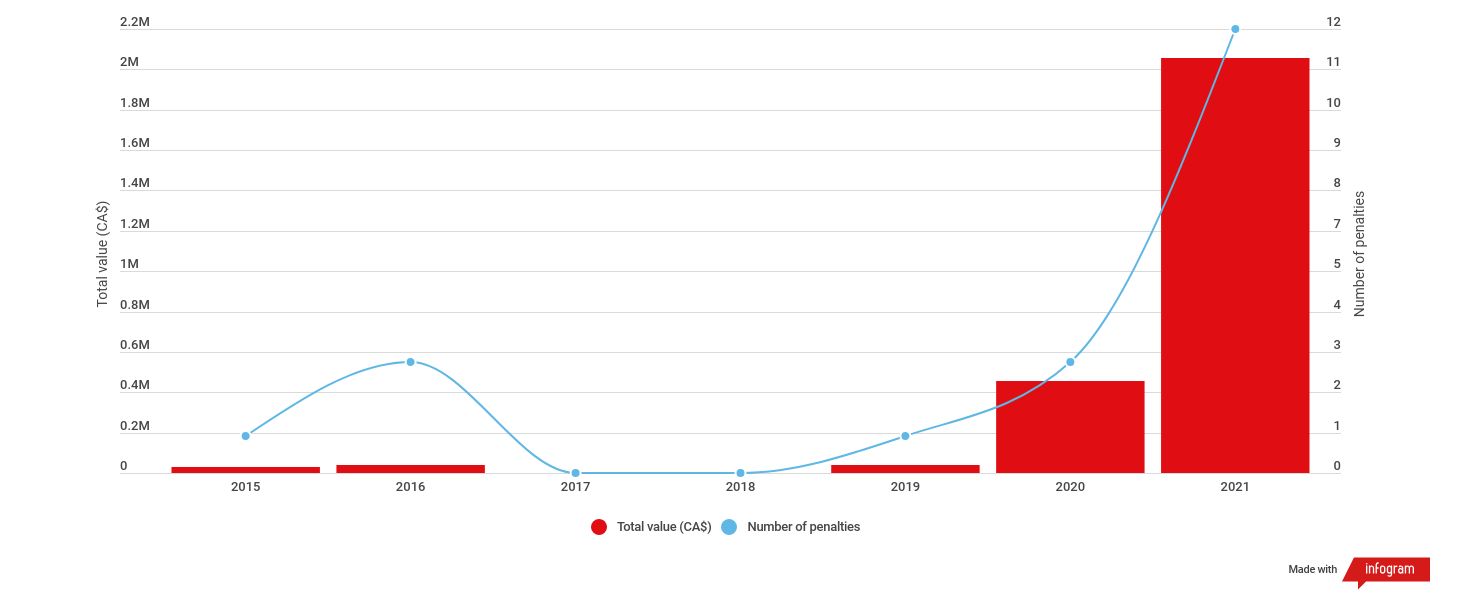

After awaking from a four-year hibernation to assess CA$455,000 in combined penalties against two money services businesses and a casino in 2020, the Financial Transactions and Reports Analysis Centre of Canada completed 12 enforcement actions in 2021, four of which targeted financial institutions, and all of which carried penalties for a grand total of $2.1 million.

Donna Achimov, Fintrac’s chief compliance officer and deputy director in charge of compliance, discussed her agency’s recalibrated approach towards enforcement in an interview with moneylaundering.com reporter Gabriel Vedrenne in April 2021.

“We … now consider the actual impact of the violation when calculating a fine,” Achimov said. “We may find … that an institution’s compliance procedures are poor but the harm they caused was not great; in others we may discover only one or two missing suspicious transaction reports, but those failures caused significant harm and therefore penalties would be higher.”

“The dollar amounts in Canada may appear lower but the goal of our enforcement actions is not punitive, it’s to encourage and change non-compliant behavior,” Achimov said last year.

Industrial and Commercial Bank of China’s branch in Toronto led the way in 2021, landing a $701,000 penalty in October after violating Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act and related regulations.

Fintrac determined that the bank failed to report suspicious transactions and properly measure and address the risk posed by certain clients. A similar batch of violations led to a $157,000 fine against Libro Credit Union Limited the same month.

The agency’s decision to focus on real estate in 2020 following revelations that billions of dollars had flown into and through British Columbia’s casinos and property market bore fruit in 2021.

Seven of Fintrac’s 12 administrative notices last year targeted real estate agencies and brokerages in Ontario, Quebec and British Columbia for roughly $660,000 in combined penalties.

Colby Adams, Kieran Beer, Larissa Bernardes, Leily Faridzadeh and Silas Bartels contributed to this article.

| Topics : | Anti-money laundering , Counterterrorist Financing , Cryptocurrencies , Sanctions |

| Source: | U.S.: OCC , U.S.: FDIC , U.S.: Federal Reserve Board , U.S.: FinCEN , U.S.: Department of Justice , U.S.: OFAC , U.S.: CFTC , U.S.: NYS Department of Financial Services , U.S.: Finra (NASD/NYSE) , U.S.: Manhattan District Attorney , Canada: FINTRAC |

| Document Date: | August 17, 2022 |