News

With STRs, Quantity Over Quality Wins the Day in Most European Nations

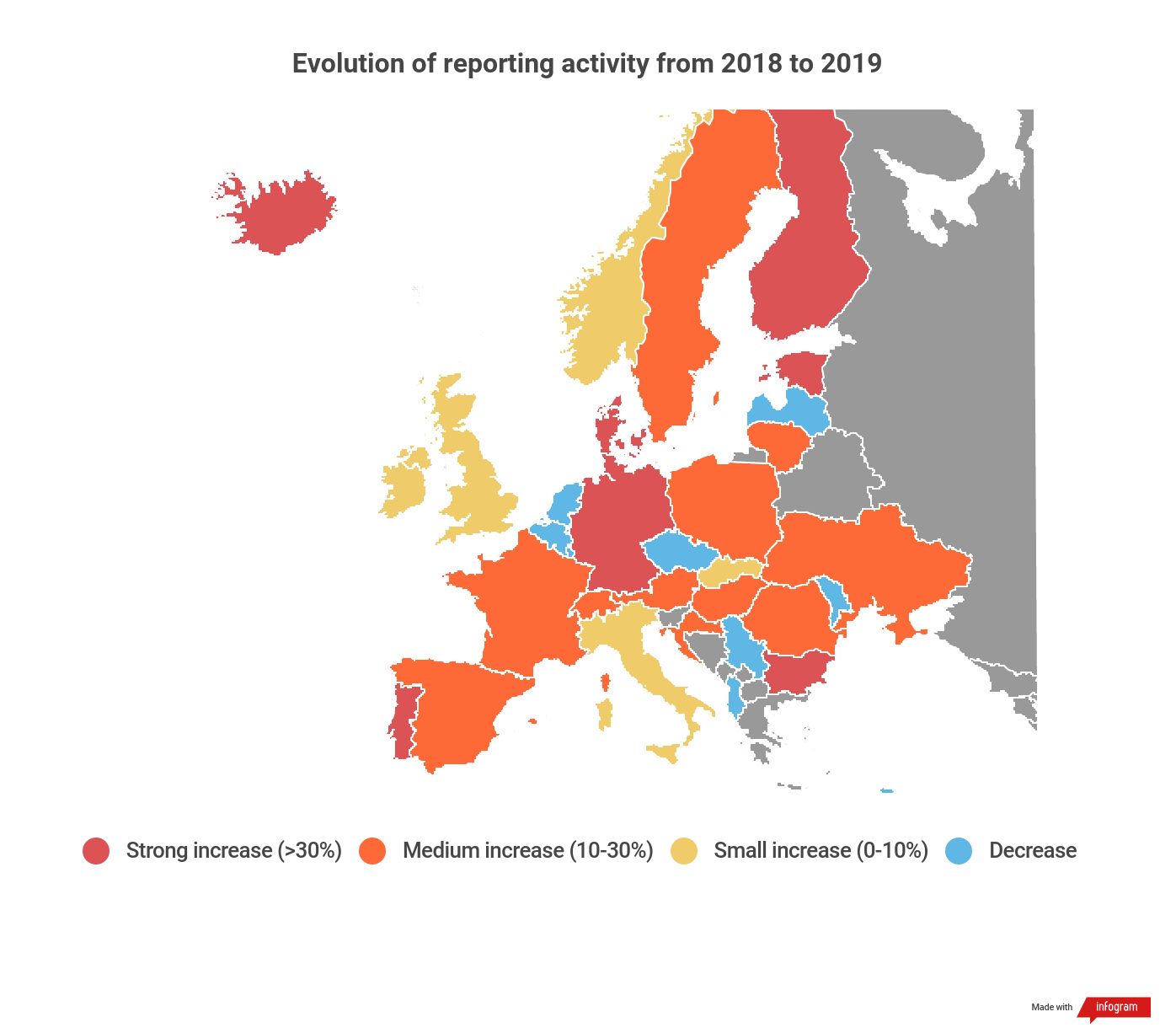

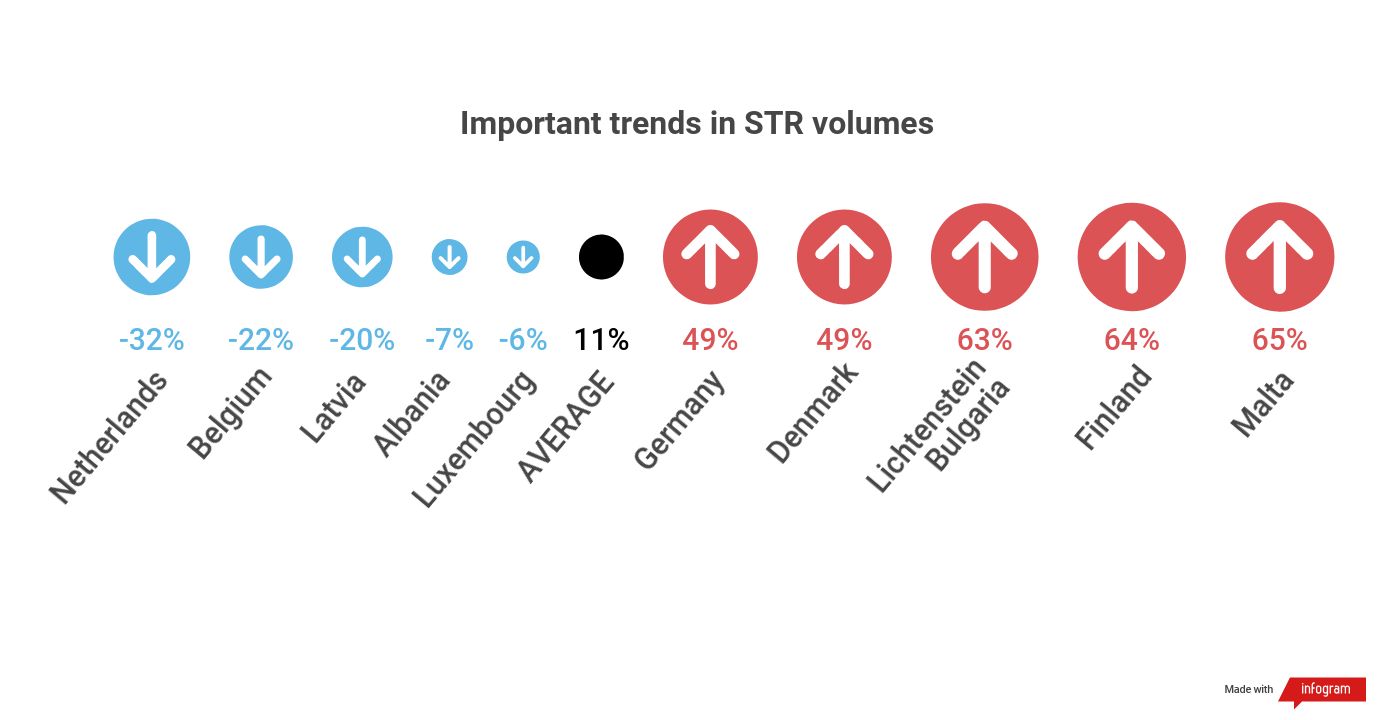

The total volume of suspicious transaction reports filed to the financial intelligence units of 34 European nations rose 11 percent from 1.1 million in 2018 to 1.2 million in 2019, marking the 10th straight year that overall reporting increased despite drops in a handful of smaller countries.

Belgium saw reporting volumes decrease from 33,500 to just under 26,000 amid a continued emphasis by the countries’ FIUs and financial regulators on quality over quantity of reporting to deter defensive filings from financial institutions. Luxembourg and Latvia also saw reporting volumes decrease – by 6 percent and 20 percent respectively – after pursuing similar strategies.

“Reporting entities have a better and better understanding of the difference between the rule-based approach and the risk-based approach that should prevail when making a suspicious transaction report,” Joke Lierman, a consultant with Compliance4Business in Waterloo, Belgium, said in reference to reporting activity in the country.

The 22 percent year-on year decrease in Belgium from 2018 to 2019 primarily resulted from “a positive adaptation of the way to report” by a single payment institution, Belgium’s financial intelligence unit, the CTIF, disclosed in June.

Implementation of the EU’s Fifth Anti-Money Laundering Directive and the country’s new emphasis on the risk-based approach to AML compliance also helped dampen reporting volumes, said Stefano Siggia, a consultant with Pideeco in Brussels.

Armed with more knowledge of the sources of their customers’ wealth and the reasons for their transactions, banks and other firms raised their thresholds for which payments qualified as truly suspicious, Siggia said.

STRs filed by the country’s casinos dropped from more than 1,100 in 2018 to just under 400 last year after a Royal decree put an end to the €10,000 and €2,500 thresholds that automatically triggered filings.

But the overall decrease may prove temporary after the recent expansion of AML requirements to cryptocurrency firms, said Lierman, the Waterloo, Belgium-based consultant.

STRs fell 6 percent last year in Luxembourg, which serves as the European financial hub for Paypal and Amazon and therefore receives all their reports.

“This decline does not in any way reflect a lower level of reporting by online providers,” the country’s financial intelligence unit, also known as CRF, concluded in its latest annual report. “The FIU regularly studies the reporting process with the entities concerned in order to make it as efficient as possible.”

Companies filing a high volume of STRs in Luxembourg have been encouraged, where possible, to stop reporting on a transaction-by-transaction basis and instead group several related suspicious transactions into a single, detailed and theoretically more-valuable report.

A 20 percent drop in Latvia’s STR volume last year followed upgrades to the FIU’s electronic platform for filing and receiving the submissions, as well as government outreach that drove “an increase in the quality” and a “decrease in the number of defensive reports,” the FIU claimed in July.

The momentum continued into the first half of 2020, with the number of STRs falling an additional 15 percent.

In the Netherlands, where financial institutions are required to report transactions deemed unusual, the number of reports rose three-fold to a record 2.5 million in 2019, but the local FIU attributed most of the rise to a since-discarded rule that obliged financial institutions to flag all transfers involving entities or individuals based in jurisdictions on an EU money-laundering watchlist.

Of those reports, almost 40,000 were identified by the FIU as truly suspicious and passed on to law enforcement agencies, down from nearly 58,000 in 2018.

All outliers aside

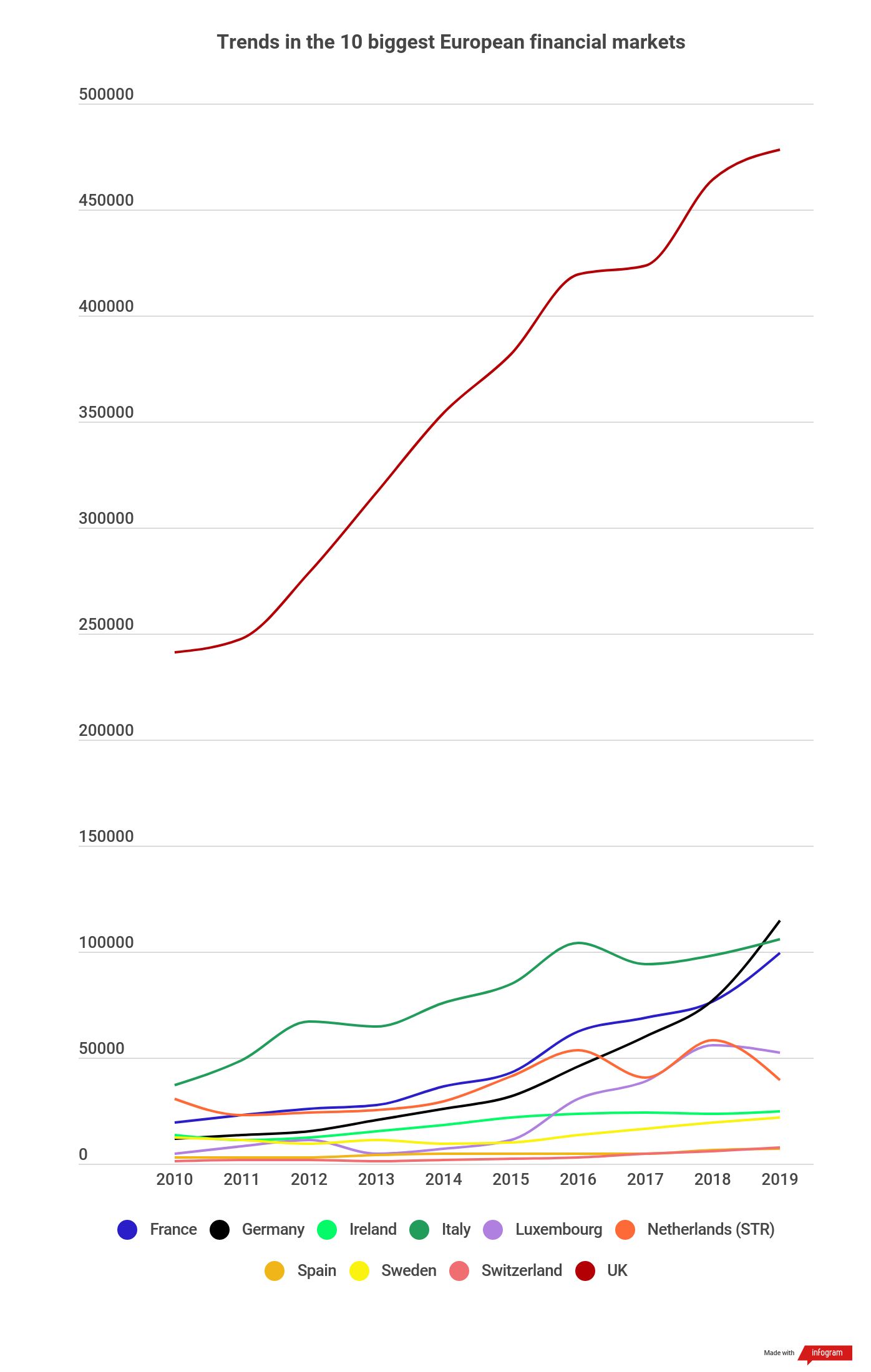

If the upward trend in STR numbers observed over the past decade in most European nations continues into December, overall reporting volumes will have tripled from 2010 to 2020 despite the handful of examples to the contrary.

Malta recorded the highest increase in Europe for the second year running in 2019 at 65 percent growth as authorities rushed to prevent the Mediterranean jurisdiction from ending up on the Financial Action Task Force’s list of jurisdictions with subpar efforts against money launderers, terrorist financiers and other criminals.

In November 2018, the European Union took the unprecedented step of directly ordering Maltese authorities to overhaul their nation’s AML regime and withdrew the license of Pilatus Bank after the lender allegedly breached U.S. sanctions and laundered millions of dollars.

Finland recorded a similar increase of 64 percent last year, according to figures provided by the country’s FIU.

FATF’s evaluation of the country and subsequent finding that supervisory authorities lacked skills and resources may have driven the increase, as did news reports alleging that Nordea, a Helsinki-based lender that ranks as the Nordic region’s largest, handled €700 million in suspicious funds from Russia and former Soviet states over a period of more than 10 years.

Denmark and Germany’s STR volumes each grew nearly 50 percent amid the scandal surrounding Danish lender Danske Bank’s branch in Estonia, which funneled more than €200 billion in suspicious funds from the former Soviet Union. Deutsche Bank, Germany’s largest by assets, handled many of those transactions as Danske’s correspondent bank.

The increase in reports came with a price: By August 2019, Germany’s FIU had accumulated a backlog of 46,000 unprocessed STRs and in July of this year was targeted with an unprecedented raid by German police for allegedly withholding critical financial intelligence from law enforcement.

Portugal, Estonia, France and Switzerland also recorded increases of at least 25 percent in STR volumes in 2019.

Contact Gabriel Vedrenne at gvedrenne@acams.org

| Topics : | Anti-money laundering , Counterterrorist Financing |

| Source: | European Union , Netherlands , Belgium , Luxembourg , Latvia , Malta , Germany |

| Document Date: | October 13, 2020 |