News

Canadian AML Supervisor Pledges More Enforcement

Canada’s primary anti-money laundering regulator and financial intelligence unit, Fintrac, which resumed assessing fines in 2020 after a nearly four-year hiatus, will continue penalizing firms for infractions in the months ahead, a senior official told ACAMS moneylaundering.com.

Regulatory changes, the novel coronavirus pandemic and the flow of tens of billions of dollars of suspicious origin into the country’s gaming and real estate sectors have forced government agencies, and Fintrac in particular, to reconsider their priorities and make adjustments.

Donna Achimov, Fintrac’s chief compliance officer and deputy director in charge of compliance, discussed these issues and the lessons that last year’s AML examinations in Canada imparted with moneylaundering.com reporter Gabriel Vedrenne.

An edited transcript of their conversation follows.

Canadian institutions operate on a fiscal year that begins in April and ends in March, which means you have just finished a fiscal year. What did Fintrac prioritize over the past 12 months, and what were the outcomes?

We implemented a new approach for real estate exams where we put more focus on assessing the compliance program. What’s really important for us on the real estate side is client identification and encouraging the industry to report suspicious transactions.

Our examinations in 2020 focused on some of the largest real estate brokers because they have the greatest share of the market and some employ dozens, if not hundreds, of agents. The focus on these large brokerages allowed us to address very targeted risks, and we spent a lot of time educating and working with various real estate associations.

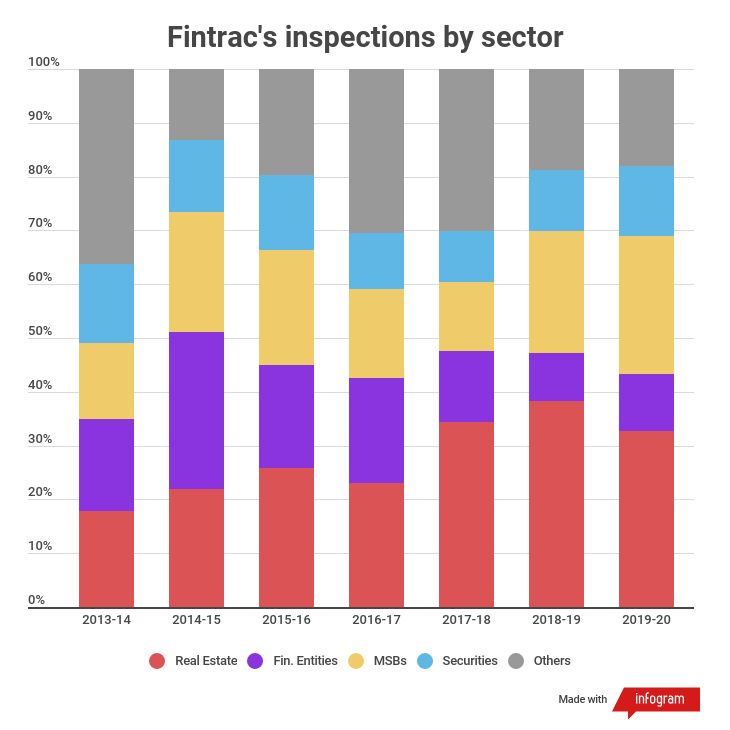

Fintrac’s examinations of the real estate sector doubled from fiscal years 2014 to 2020, while examinations of financial institutions dropped by a third. Aside from enhanced scrutiny of real estate, what other initiatives did Fintrac pursue?

Financial institutions, casinos and money services businesses are also considered high-risk and we constantly look at how business is functioning in these areas, but we also had to prepare ourselves to pay more attention to transaction monitoring.

Another very important initiative was implementing the Finance Ministry’s directive in July to apply enhanced monitoring to transactions associated with the Islamic Republic of Iran. So we built it into our examinations: all applicable reporting entities have to report any transactions that have anything to do with Iran to us, regardless of their dollar value.

That was a significant effort, and we’ll start to check compliance with these new obligations in the coming months.

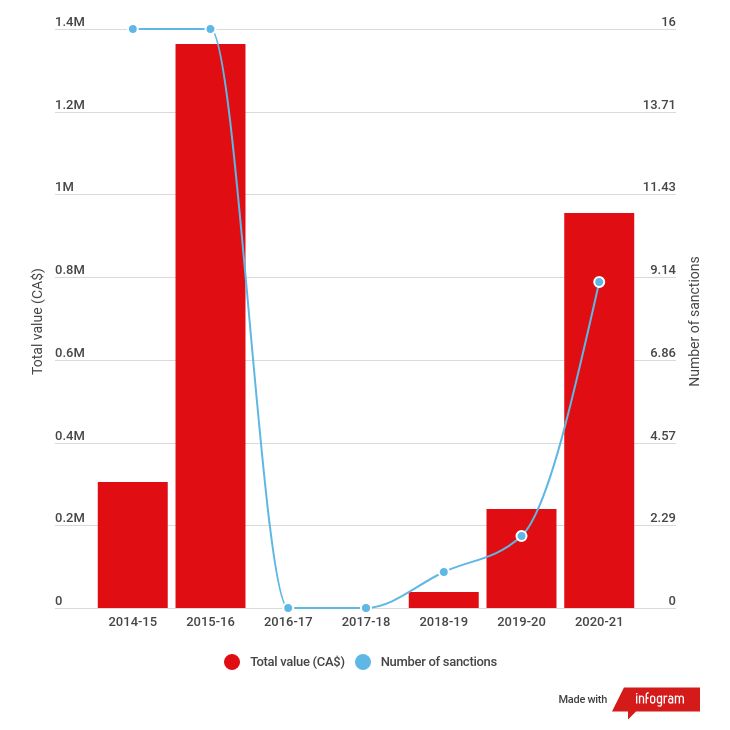

Fintrac also imposed three AML-related monetary penalties in 2020, with the exception of a small, nonpublic fine in the 2019 fiscal year, represent the first such penalties since 2016. Could you remind us why Fintrac had to pause enforcement for so long?

We had to contend with two quite significant federal court challenges [to the agency’s enforcement policies] in 2016. This led to a total overhaul of our program and issuances of detailed guidance and policies [to reduce the possibility that the agency’s decisions will be overruled in court].

Our administrative monetary penalties are much more focused and refined, and we now have the ability to publicly identify institutions that have not complied with AML regulations.

Fintrac’s penalties appear small when compared to those of other national AML regulators. Does that not limit deterrence?

The dollar amounts in Canada may appear lower but the goal of our enforcement actions is not punitive, it’s to encourage and change non-compliant behavior.

We also now consider the actual impact of the violation when calculating a fine. We may find in some instances that an institution’s compliance procedures are poor but the harm they caused was not great; in others we may discover only one or two missing suspicious transaction reports, but those failures caused significant harm and therefore penalties would be higher.

The number and value of fines that Fintrac imposes for AML breaches appear to be trending upward. Should we expect more monetary penalties in the near future?

We do expect to have additional fines or penalties. We issued nine so far this fiscal year [not all have been made public yet]. More will come because we are doing much more robust and detailed assessments, so we are finding shortcomings. Our approach in Canada is not to penalize, but to educate, to point out weaknesses and be constructive in terms of how entities can improve.

We always wonder: are more fines or less fines an indicator of success? Less fines may indicate that we have succeeded in changing behavior.

How did COVID-19 impact your examinations and overall activity?

COVID-19 was this overarching issue that everyone dealt with. We always had the ability to conduct desk assessments, but COVID pushed us to move more into the virtual sphere. We had initiated several examinations prior to COVID, so we finished those and then shifted more to desk exams.

When COVID was at its worst in Canada, we put a pause on initiating any new examinations for a few months, but we kept looking at our reporting trends and adverse media. COVID has also unexpectedly had good consequences: Because we are working virtually, we can now recruit talent from any part of the country.

Let’s finish with Fintrac’s goals and supervisory priorities for the months ahead.

Our priorities remain more or less the same, we continue to focus on high-risk sectors, namely real estate, casinos, financial entities and money services businesses. We will also see some additional regulatory changes related to virtual currency, beneficial ownership, identification of politically exposed persons and other areas.

Contact Gabriel Vedrenne at gvedrenne@acams.org

| Topics : | Anti-money laundering , Counterterrorist Financing |

|---|---|

| Source: | Canada , Canada: FINTRAC |

| Document Date: | April 26, 2021 |