News

Canada Pledges More Dollars, New Legislation for AML Overhaul

Canadian officials want to extend anti-money laundering requirements to unregulated mortgage lenders and other new sectors in the years ahead, while also dramatically boosting spending on AML supervision, financial crime investigations and corporate transparency.

But between an impending database of ownership information that does not yet apply to locally registered firms, a planned anti-financial crime agency with an undefined remit, and new funding that will mostly serve to bring Canada’s primary AML regulator up to speed, the federal government’s latest five-year budget has no shortage of gray areas to address.

“Implementation will be the real test as the devil is in the details,” Bob Kapur, former deputy chief AML officer with the Canadian Imperial Bank of Commerce, told ACAMS moneylaundering.com.

Canada’s latest five-year plan frames the fight against financial crime with more seriousness than previous versions, in both focus and funding. Whereas last year the federal government set aside only $5 million to combat illicit finance through fiscal year 2026, officials now aim to spend $92 million through 2027.

The proposal is now under review by Canadian lawmakers, who are expected to approve a final version by June.

‘Convoy’ consequences

Canada’s red-hot housing market still forms a key gap in the nation’s defenses against financial crime as most real estate professionals either disregard or do not know of their sector’s exposure to illicit finance, their current due-diligence and reporting obligations.

The Cullen Commission—a three-year government inquiry into illicit finance in British Columbia set to conclude next month—estimates that up to $5.3 billion of illegal cash flowed into the province’s property market in 2018 alone, inflating housing prices by as much as 5 percent.

Canadian federal authorities, including the Financial Transactions Reports Analysis Centre of Canada, or Fintrac, have since sought to strengthen supervision of real estate professionals while countering a new threat: “mortgages issued by lending businesses not regulated under national AML rules.”

The latest five-year budget plan would therefore see AML requirements extended to such companies.

Crowdfunding platforms and payment services providers that offer “online money pots” would also have to vet their clients and report suspicious activity under the plan, after three fundraising drives linked to the controversial “Freedom Convoy” protests drew in more than $20 million in contributions, a sizeable portion of which arrived from across borders.

More broadly, following “a comprehensive review” of Canada’s AML regime, “additional legislative proposals will be brought forward over the coming months,” the government stated without providing further details.

Big boost

To monitor these new sectors, Canadian officials plan to set aside $90 million of the $92 million in proposed AML-related funding for Canada’s financial intelligence unit, Fintrac, which doubles as a federal AML supervisor.

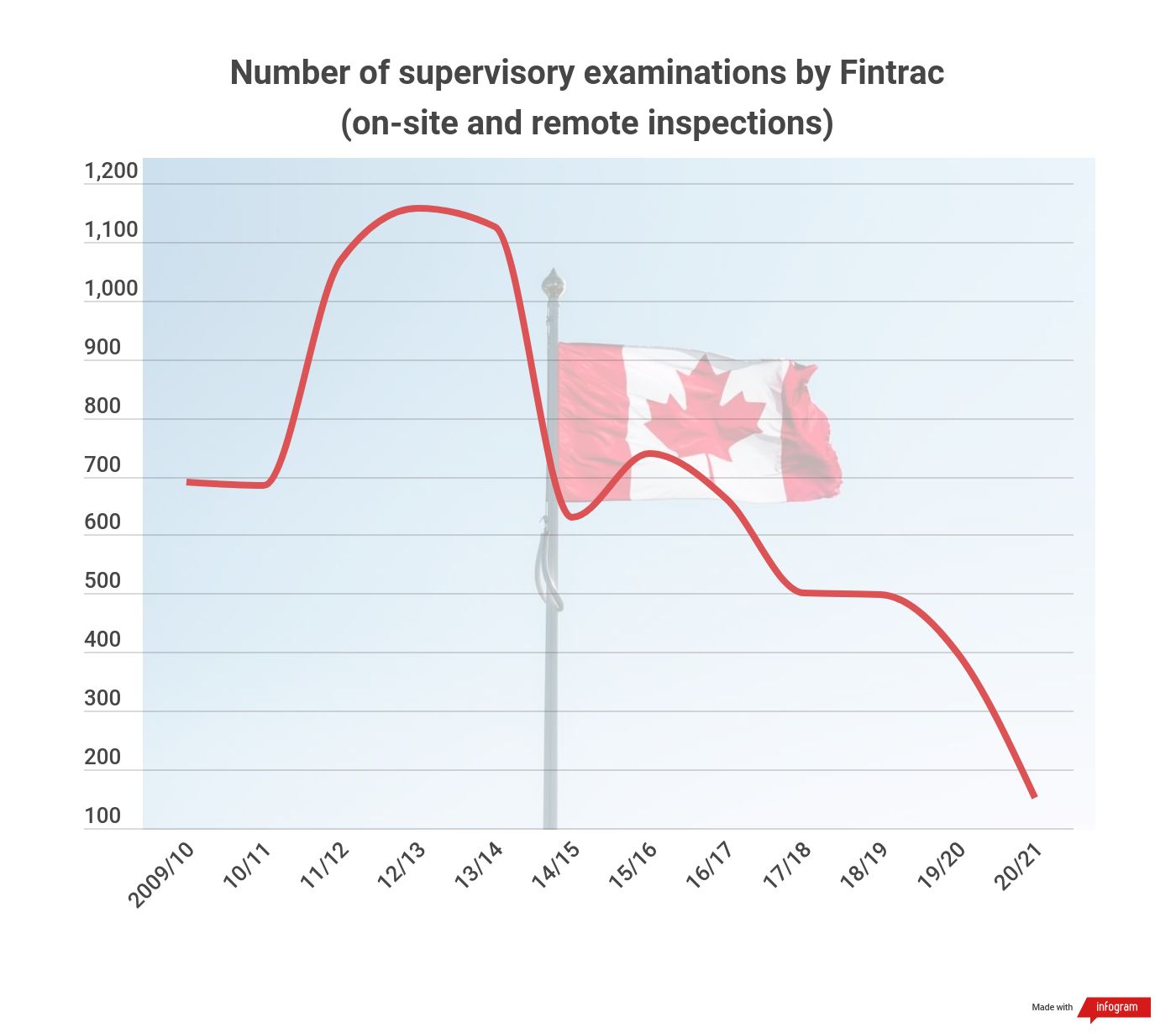

The new budget would cover Fintrac’s operating costs through 2027, including the agency’s efforts to reverse a five-year decline in the number of onsite inspections and raise its current staff count of 412 employees to 465 employees by 2027.

“The financial boost is a veiled admission that Fintrac does not have adequate resources and knowledge to conduct its supervisory tasks effectively, as illustrated by the shocking decrease in inspections,” Nicolas Choules-Burbidge, a consultant in Toronto, told moneylaundering.com.

Fintrac’s problems began in 2016 when the government transferred responsibility for AML supervision from the Office of the Superintendent of Financial Institutions to the FIU, said Choules-Burbidge, who led OSFI’s AML division for 17 years.

“The government is now helping Fintrac duplicate the kind of expertise it already has at OSFI,” he said. “This is a waste of time and taxpayers’ money, as supervision by OSFI was funded by the regulated entities.”

Who owns this?

Canadian real estate’s appeal to money launderers and other criminals not only stems from the sector’s lack of vigilance and knowledge, but also from a dearth of information that would identify who owns the legal entities that buy property.

Originally planned for 2025, the federal government now wants to launch a publicly available and searchable register of beneficial owners from 2025 to 2023 to more quickly address the issue.

But the plan will only apply to federally registered entities, leaving it to the provinces to decide whether or not to require locally registered entities to submit their information to the government in Ottawa, said Kapur, now an AML consultant in Toronto.

“We’ve seen little progress,” he said. “If provinces do not follow the federal move, this could lead to regulatory arbitrage and we would keep on playing whack-a-mole with money launderers.”

The budget also includes a vague pledge to take “a national approach” to building a separate database of property owners, an uncertainty that the government may have exacerbated by not proposing to extend AML rules to attorneys, notaries and corporate services providers despite their regular involvement in real estate payments and shell-company formation.

“This is a major gap that puts Canada offside of international standards,” said Choules-Burbidge, who cited repeated criticism by FATF, most recently in October, when the group found that certain “relevant” non-financial professionals in the nation still operate outside of AML requirements.

New sheriff

All of the measures listed above aim to improve the detection of suspicious transactions and assist investigations into complex, multi-tiered money-laundering schemes. The proposed budget would give responsibility for the latter task to the Canada Financial Crimes Agency, a new agency whose mission, powers and launch date will be unveiled this autumn.

“Most, if not all, police agencies are failing to manage the volume and complexity of these cases,” Stephen Scott, a former financial investigator with the Royal Canadian Mounted Police, told moneylaundering.com.

Canadian officials also plan to review Canada’s Proceeds of Crime and Terrorist Financing Act and related legislation for possible amendments that would “enhance the ability of authorities to detect, deter, investigate and prosecute financial crimes,” but did not give further details.

Contact Gabriel Vedrenne at gvedrenne@acams.org

| Topics : | Anti-money laundering , Counterterrorist Financing |

| Source: | Canada , Canada: FINTRAC , Canada: OSFI |

| Document Date: | May 12, 2022 |