News

Malta’s AML Battle Enters the Courtroom

Satabank’s successful challenge against a fine imposed by Malta’s primary anti-money laundering supervisor, FIAU, represents the latest manifestation of the private sector’s growing resistance to the Mediterranean island’s increasingly active rate of enforcement.

In October 2018, Malta’s Financial Intelligence Analysis Unit, or FIAU, fined Satabank, a midsized lender headquartered in the coastal town of St. Julian’s, €328,000 after finding the bank in “systematic breach” of its obligation to reply swiftly and accurately to requests for information on 22 separate occasions.

But Malta’s Court of Appeal ruled in favor of Satabank on May 25 and reduced the €328,000 that the action carried against the lender by a factor of five, down to €68,000, in a case that marks neither the first nor last in which a Maltese lender has challenged the agency in court.

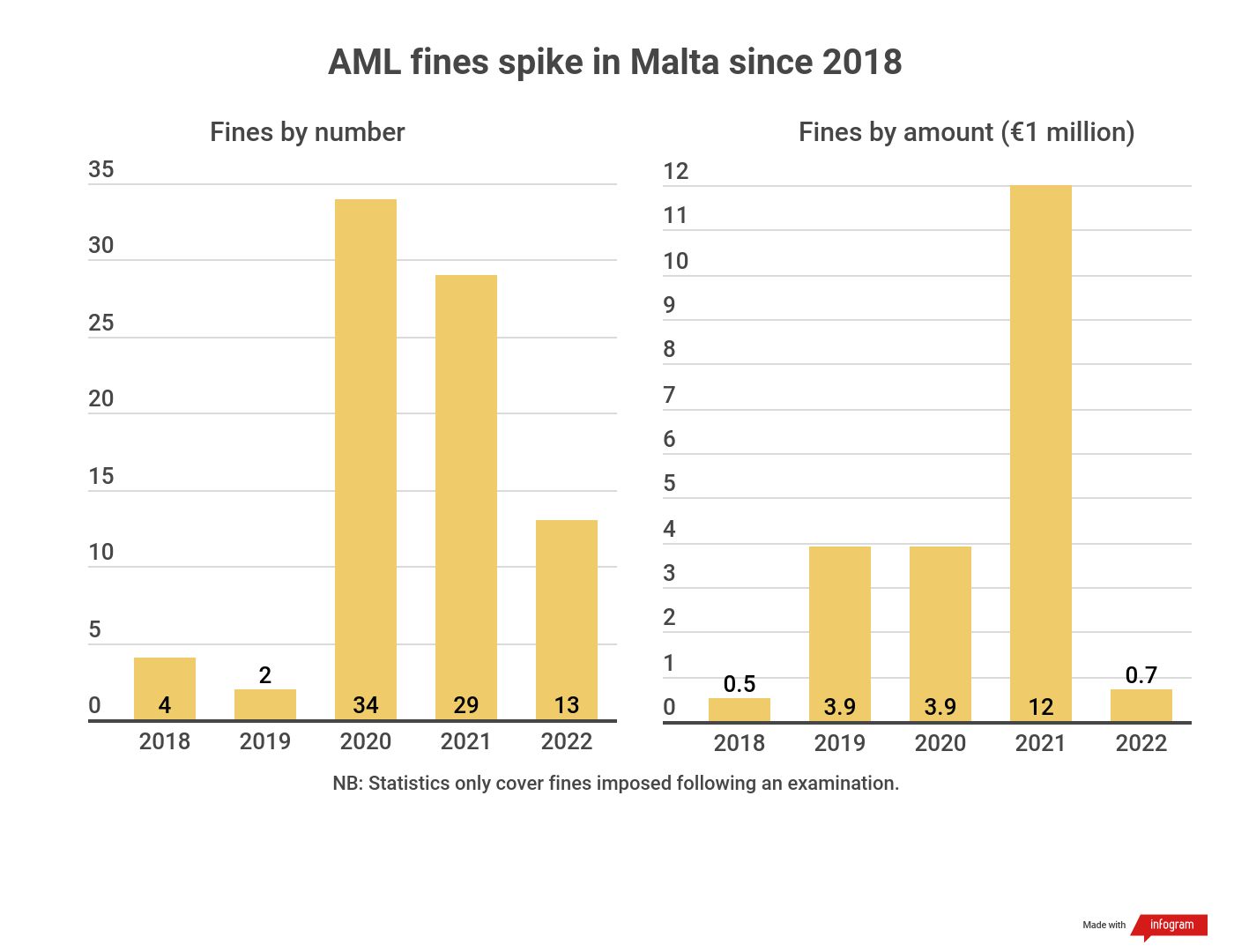

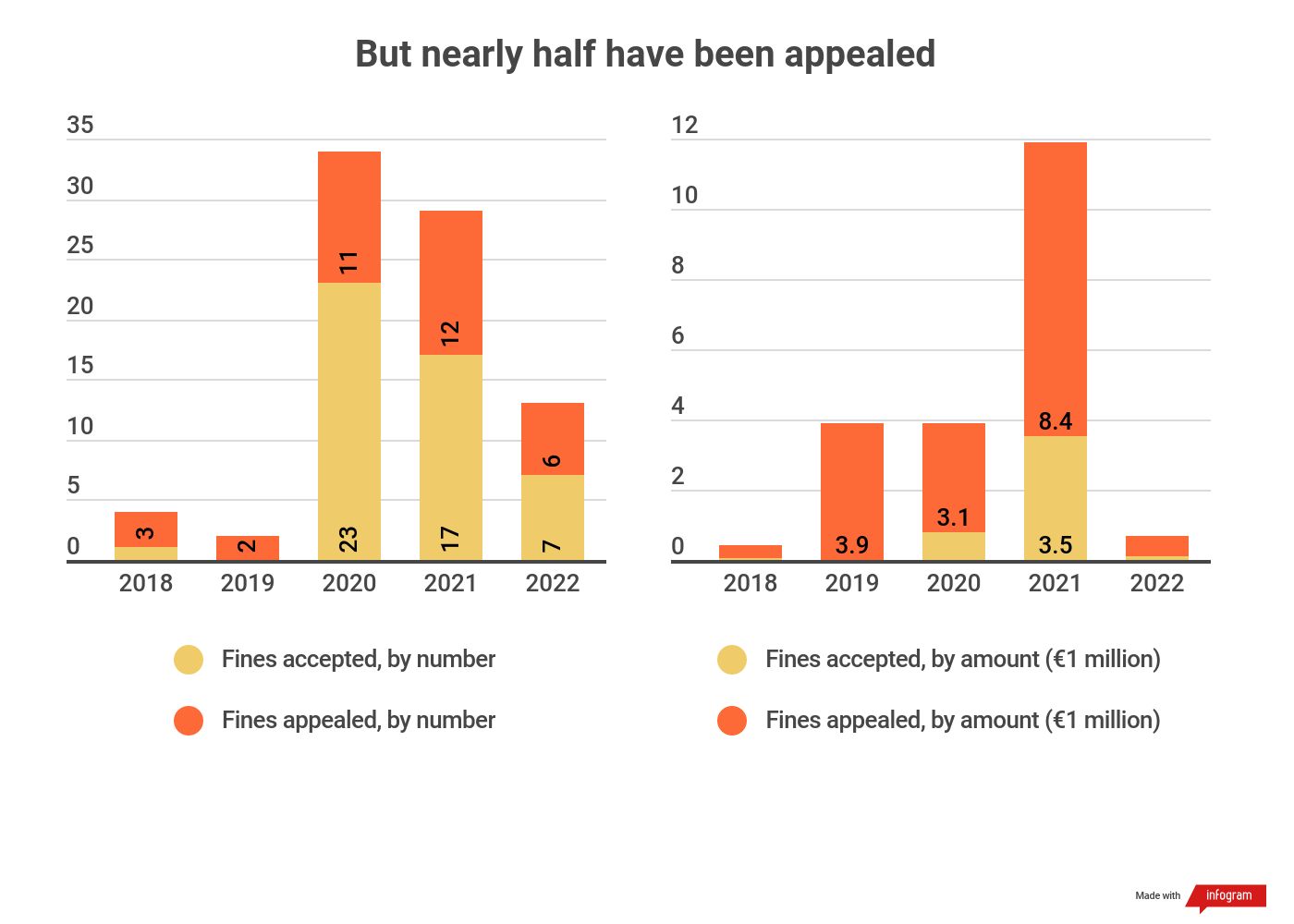

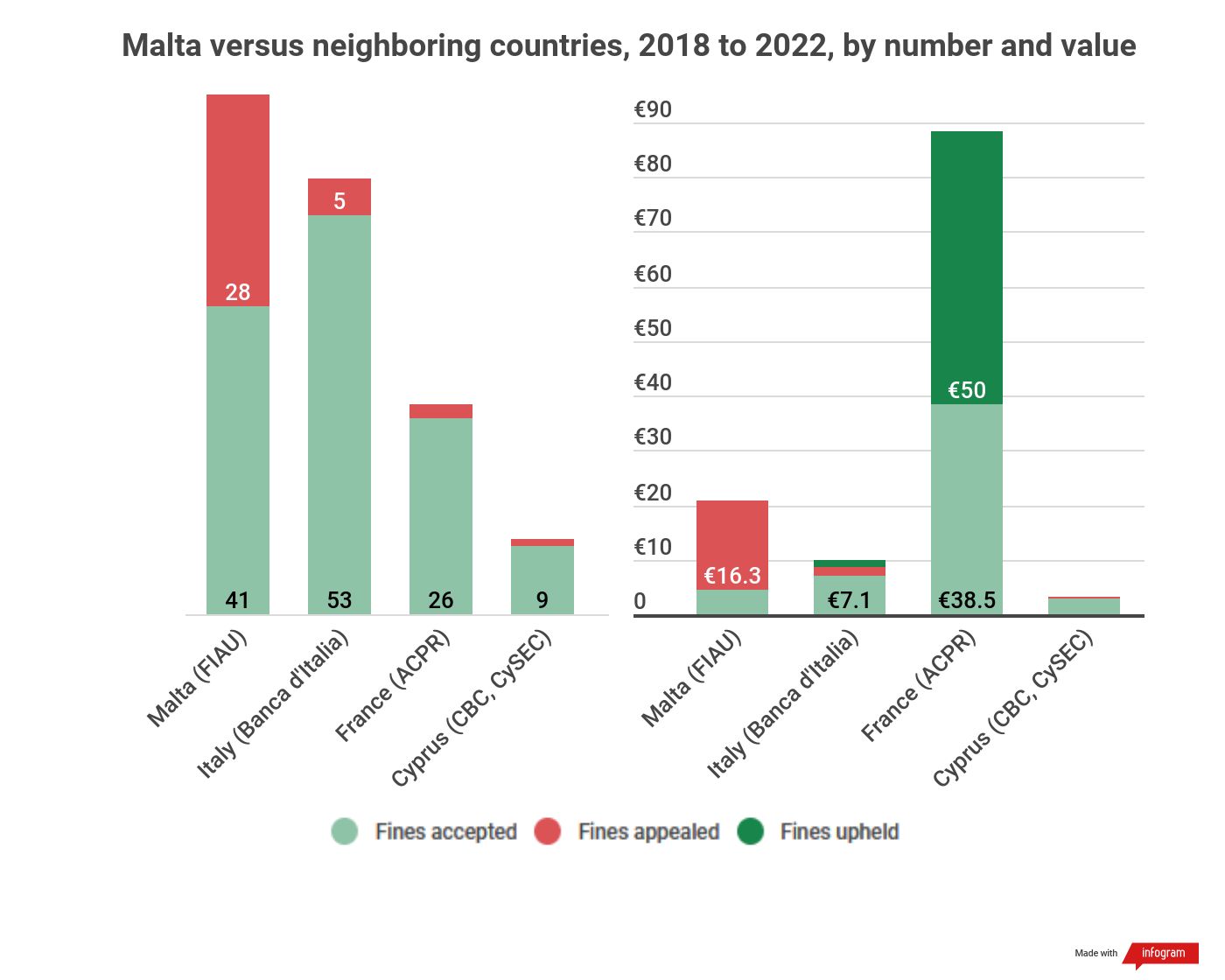

No fewer than 40 percent of the 82 AML-related fines imposed against Satabank and other Maltese firms since January 2018 have been appealed, suggesting that Malta’s plan to maintain stronger supervision over its all-important financial services sector a year after escaping a global gray list of nations with lax AML regimes now treads a rocky path.

The combined value of AML fines either appealed or now under appeal in Malta amounts to €16.4 million of the €20.8 million in total penalties FIAU has sought to extract over the past four years.

The four institutions that have won their appeals to date—Satabank twice, wealth management firm Integra Private Wealth, an unidentified payment services provider and an unidentified accountancy—reduced their fines by 80 percent on average, a rate that regulators fear will incentivize more companies to contest their penalties.

“With such reductions, we are, from an enforcement point of view, moving back to 2015,” FIAU Director Kenneth Farrugia told ACAMS moneylaundering.com. “If we continue like this, in the long run, the effectiveness and dissuasiveness of our framework may be impacted and called into question once again.”

In July 2018, nine months after journalist Daphne Caruana Galizia was murdered while investigating grand corruption and suspicious payments at the highest levels of government, the European Banking Authority criticized FIAU for not adequately enforcing AML rules.

EU officials then directly ordered FIAU to prioritize supervision of higher-risk over lower-risk institutions, react more promptly and forcefully to AML breaches, and reconsider its policies for calculating and imposing penalties.

“2018 was the end of an era,” Georgios Mallios, who worked as a money laundering reporting officer for FIMBank from 2018 to 2021, told ACAMS moneylaundering.com. “Maltese authorities were under pressure and needed to show results, so they went for the low-hanging fruit,” Mallios said.

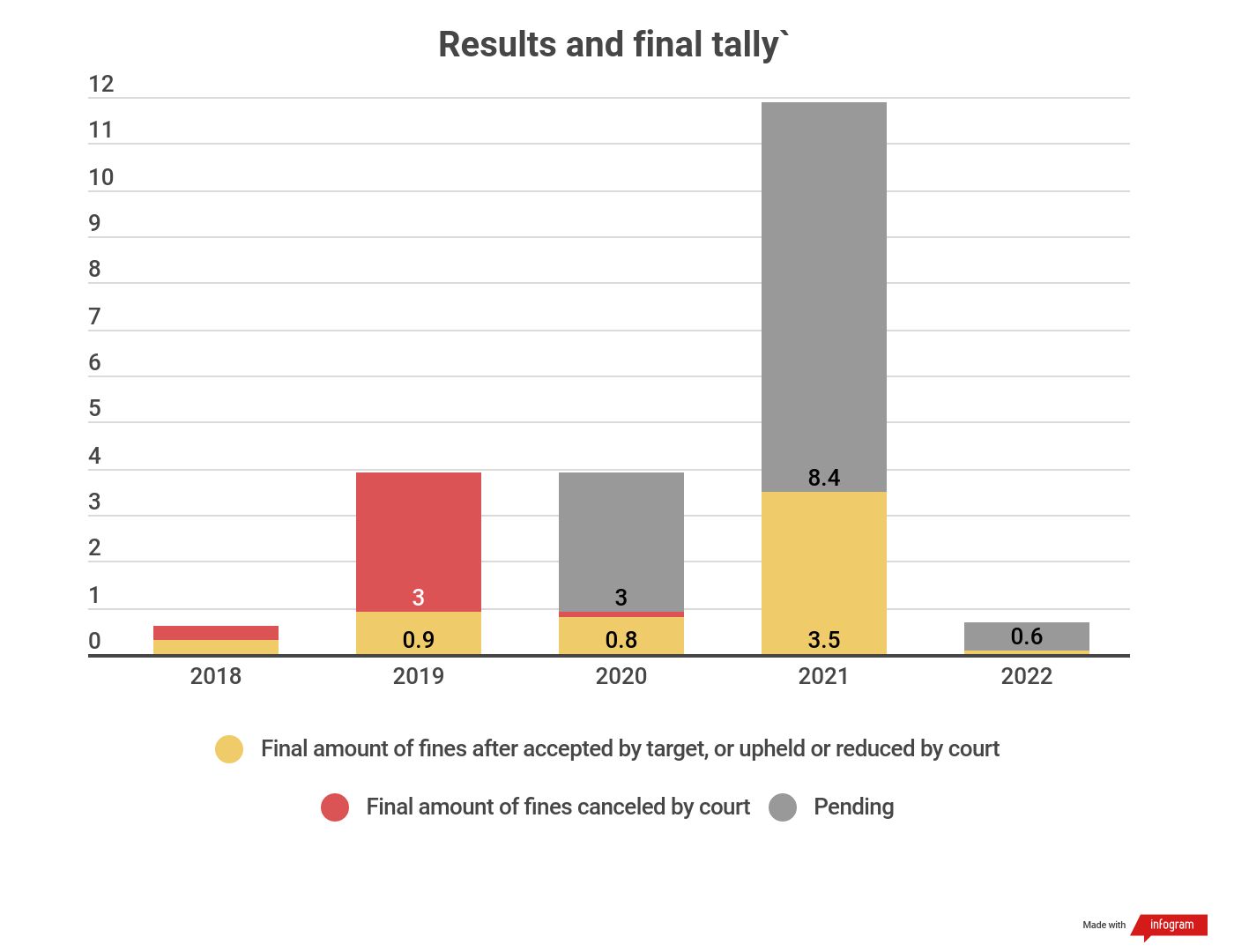

Enforcement rose dramatically after EBA’s criticism, from two fines for a combined €454,000 in 2018 to 29 fines for a combined €12 million last year.

On May 25, the same day that the Court of Appeal reduced Satabank’s penalty to a fraction of the original amount, EU lawmakers praised FIAU’s reinvigorated enforcement campaign for having already “yielded tangible results.”

But the upward curve paints a partial picture of AML in Malta since 2018, because the same legislation that gave FIAU new powers to penalize and a clearer mandate to use them also provided banks, money services businesses, and other companies and professionals a new avenue to challenge their penalties in court.

FATF noted the problem after evaluating Malta in 2019.

“The FIAU’s appetite to apply higher penalties has recently increased,” the group concluded in a report following the evaluation. “However, the vast majority of sanctions [penalties] imposed in 2018 by the FIAU are not yet in force, as they are subject to judicial appeal.”

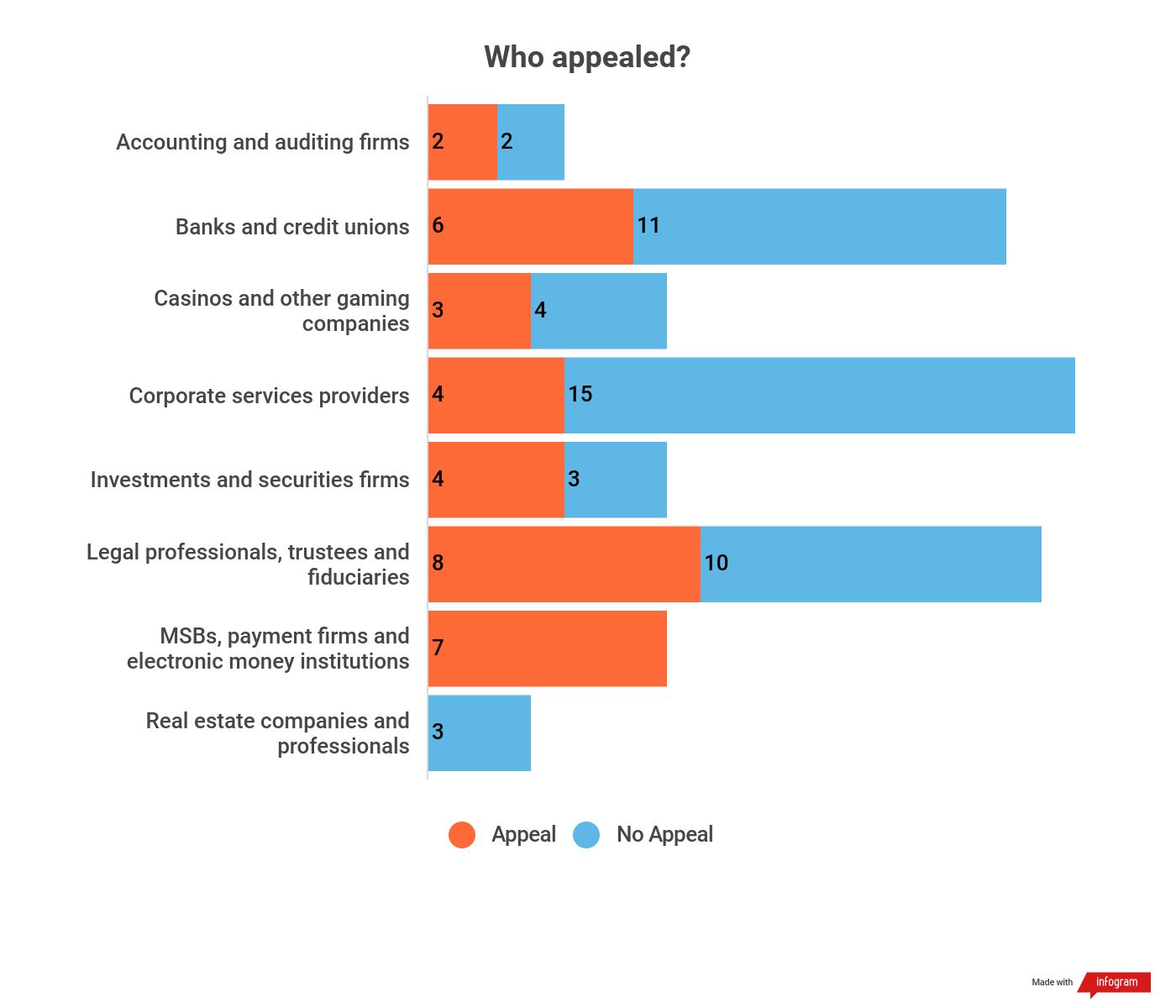

FATF’s observation still holds water, as no fewer than 34 of the 82 banks, casinos and other companies that incurred AML penalties in Malta from January 2018 to June 2022 have petitioned a judge to review and reverse those decisions.

Together those cases aim to upend €16.4 million of the €20.8 million in total fines FIAU sought to extract from the accused, and only a small fraction of them have been adjudicated.

Lawfare

Appellants frequently question FIAU’s authority to enforce and argue that the agency disregards their explanations and concerns before penalizing them, but they first and foremost seek to reduce their fines by casting them as “excessive” or “disproportionate.”

“The quantum [FIAU’s system for calculating penalties] seems to be a bone of contention for obliged entities,” officials told moneylaundering.com. Judges who agree to reduce penalties in the context of an appeal encourage more institutions to contest their cases, regardless of merit.

The higher the penalty, the more likely an appeal will be filed, officials said, and an analysis of the agency’s enforcement actions since January 2018 supports that view.

Financial institutions that appeal their cases delay having to pay the fine, temporarily preserve their cash flow and win more time to upgrade their AML programs, a banking consultant in Malta said on condition of anonymity.

“This is a rational strategy, especially since while supervisors have changed significantly since 2018 and taken a new approach, the courts are still sitting on the fence.”

The frequency with which targets of penalties take their cases to court can also be read as an indicator of the island’s attitude towards anti-financial crime compliance before 2018.

“There wasn’t a culture of being held accountable until recently, and many appeals are a legacy of this state of mind,” said Mallios, the former money laundering reporting officer at FIMBank.

Outlier

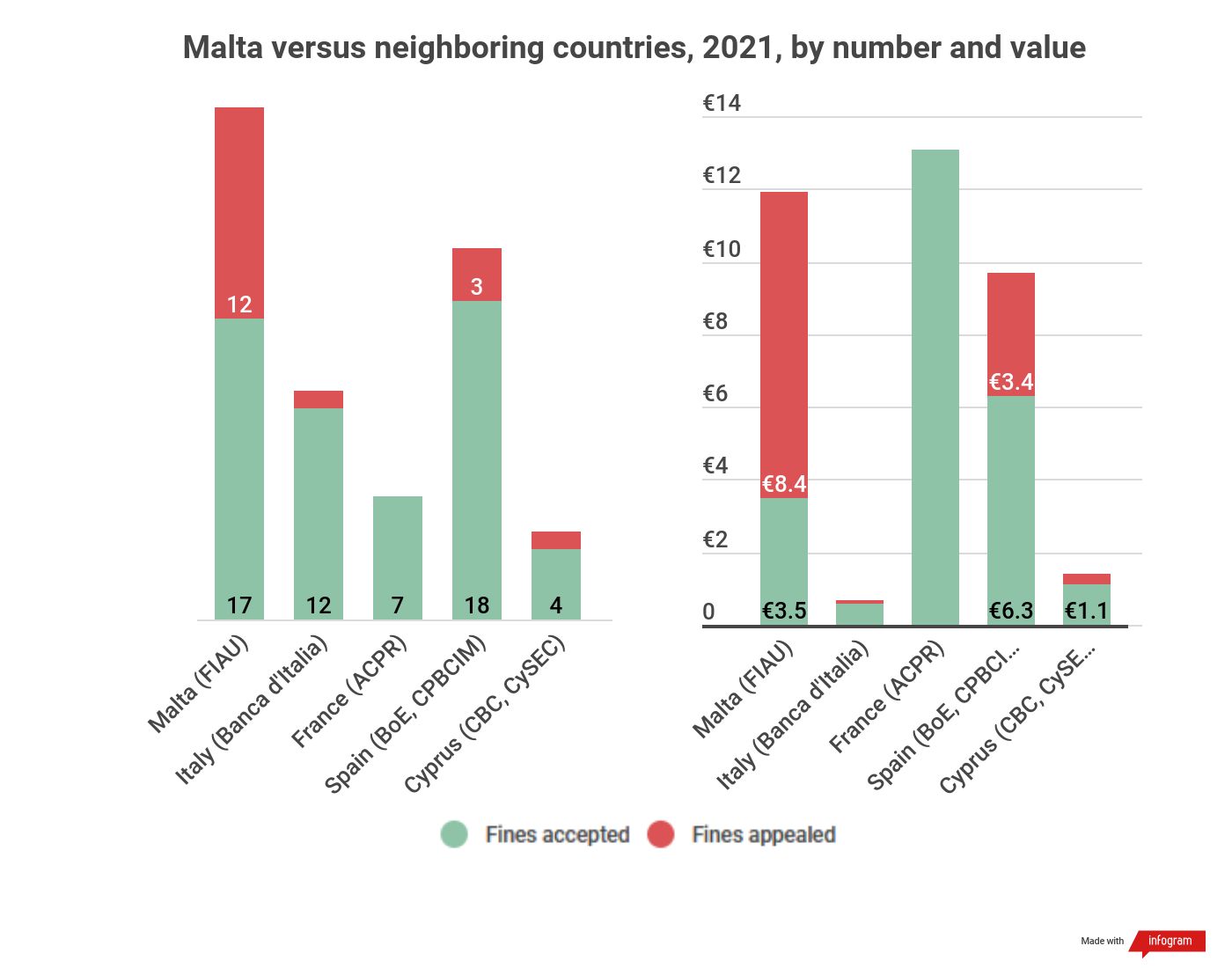

The right to appeal against an unfavorable legal or regulatory decision forms an integral part of Democratic governance and rule of law, but the frequency with which institutions in Malta now exercise that right has no peer.

Twelve of the 29 fines imposed in Malta in 2021 are the subject of an ongoing appeal, as compared to only three of the 21 AML-related penalties assessed in Spain and one of the 13 AML-related actions finalized in Italy.

None of the seven institutions fined last year for violating France’s AML rules asked a judge to review their case. In neighboring Cyprus, where the risk of illicit finance rivals that of Malta, only one of the five AML fines regulators assessed in 2021 ended up in court.

Stretching the analysis back to 2018 yields similar results, as fewer than 9 percent of the 96 total AML-related enforcement actions taken in Cyprus, Italy and France in the past four years triggered an appeal.

Malta’s rate of appeal exceeded 40 percent during the same period, but FIAU dismissed suggestions that the island’s outsized and dominant financial services industry has taken up a “legal revolt” against tougher enforcement.

Whatever the case, Maltese courts have a mountain to climb in the months and years ahead. Only seven of the 34 total AML-related appeals filed in the past four years have concluded, with the initial fine confirmed in two cases and reduced in the remaining five.

“The courts are an integral component of Malta’s AML framework,” Farrugia, FIAU’s director, told moneylaundering.com. “But we can’t go against one another, with one applying an overhauled, internationally reviewed and accepted enforcement methodology and the other sticking to an old and ineffective one.”

Contact Gabriel Vedrenne at gvedrenne@acams.org

| Topics : | Anti-money laundering , Counterterrorist Financing |

|---|---|

| Source: | Malta |

| Document Date: | July 12, 2022 |